Are you next? Every 22 seconds, someone becomes a victim of identity theft. And most people never see it coming. In 2025, identity theft prevention starts with a simple, shocking truth: Your password habits are either your greatest defense or biggest liability. Which is it for you?

How much does the average person lose from identity theft?

The costs of identity fraud are crushing for those who can least afford it: low-income households, women, and older adults.

On average, a victim loses $1,600 to identity theft, a devastating blow for families living paycheck-to-paycheck.

According to the 2025 ITRC report, 41% of identity theft cases involve those earning less than $20,000/year. These victims not only lose money but also face lost wages, spending an average of 200 hours to resolve issues.

Meanwhile, a staggering 65% who report identity theft to the ITRC say their issues remain unresolved a year later.

How does identity theft happen?

Identity theft is skyrocketing, and 2025 is set to be a record-breaking year. In Q1 alone, the FTC tracked 365,758 cases of identity theft, exceeding 2024 figures by an astounding 72,328 cases.

Think you’re safe? Check out the table below to see how easy it is for scammers to target you.

|

Method/technique |

Description |

Statistics |

|

Phishing |

Emails, texts, and messages sent to trick you into sharing sensitive info |

|

|

Dark Web sales |

Your stolen data sold on Dark Web marketplaces |

|

|

Synthetic identity fraud |

Your identity + fake info = synthetic identities. Used to apply for loans, credit cards, and government benefits

|

|

|

Deepfake media |

AI-generated audio and video used to impersonate you or trusted contacts

|

|

|

SIM swapping |

Your texts, calls, and MFA codes intercepted by scammers after they trick your mobile carrier into transferring your number to a SIM card they control

|

|

|

Digital document forgery |

Your information + AI = fake ID documents.

|

|

|

Application fraud |

Your stolen data used to open new accounts and loans in your name

|

|

How can Social Security identity theft occur?

Suddenly, your benefits are being re-routed and your good name used for crimes you didn’t commit. How did this happen?

In 2024, the SSA’s Office of Investigations handled 332,927 Social Security identity theft cases. The majority involved private citizens (59.9%).

Here are the top tactics scammers are using to commit Social Security identity theft:

- Phishing attacks. Scammers pretending to be from the Social Security Administration (SSA) send phishing emails with SSA branding, case numbers, and official-sounding subject lines like, “Your benefits statement is now available for download.”

You’re instructed to click a “Download Statement” button or link, but what you’re really doing is installing a malware-infected file on your device. Note that such emails never have .gov as part of the sender’s address, which means they’re scams.

To create urgency, you’re often asked to “verify” your Social Security details to avoid losing your monthly payments or COLA (cost-of-living-adjustment) increase. Sometimes, you’re threatened with an arrest or account seizure. Don’t fall for it!

- Dark Web marketplaces. In 2025, scammers are selling full access to stolen Social Security accounts, which are often obtained through successful phishing attempts.

- Impersonation calls. Scammers impersonate SSA officials and call you, claiming that your Social Security number has been suspended or involved in illegal activity. They may threaten legal action or demand immediate payment to “resolve” the issue.

Remember: The SSA will never threaten you with arrest or legal action if you don’t immediately pay a fine or fee.

- Data matching and educated guessing. Scammers may use information from obituaries (like the birth date and birthplace) to guess a Social Security number.

Research from Carnegie Mellon has shown that it’s possible to make educated guesses about someone’s SSN, especially if they were born before the SSA’s 2011 randomization policy. Today, however, most scammers prefer to use phishing to get your Social Security number.

- Excess payment scams. You may receive a call, text, or letter claiming that the SSA has overpaid you. The scammers threaten to withhold future payments until you send the “overpayment” back in the form of a gift card, crypto payment, or Cash App transfer.

They’ll likely ask you to verify your Social Security number to “update” your account. The real goal is to steal your identity and funds.

Remember: The SSA will never ask for payments in a way that’s difficult to track. This includes internet currency, cash, pre-paid debit cards, wire transfers, and gift cards. Also, be wary of anyone who contacts you and asks for your SSN or payment, especially if you didn’t initiate the contact.

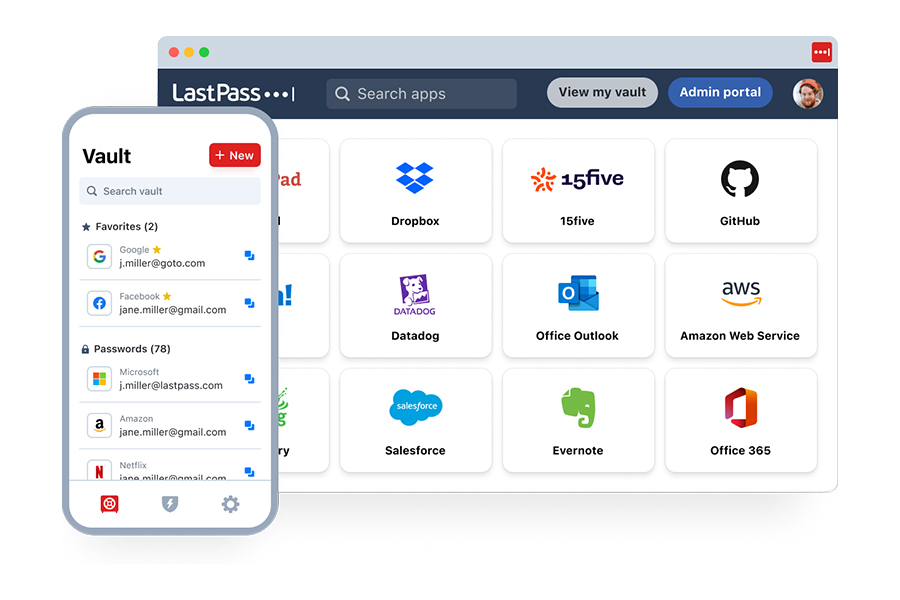

- Access passwords anywhere, anytime

- Generate unique, strong passwords

- Autofill and share with one click

- Backed by expert threat intelligence

How can tax identity theft occur?

Tax identity theft occurs when scammers use your Social Security number and other identifying details to file a return in your name.

Picture this: You file your taxes, expecting a nice refund. Instead, you get a message that says, "A return with your Social Security number has already been filed.”

Is it an ex-spouse or identity theft? If you suspect identity theft, don’t panic. According to the IRS, there are two important steps you can take to protect yourself:

- File a paper tax return if you can’t e-file.

- Complete Form 14039 (Identity Theft Affidavit), attach it to the back of your completed paper tax return, and mail them both to the IRS location based on the state you live in. Alternatively, you can submit the Form 14039 online and mail your paper return separately.

If, however, you received a letter (5071C, 4883C, or 5747C) from the IRS stating that a suspicious tax return was filed in your name:

- You must either access the IRS online verification tool or call a toll-free number to tell the IRS whether you did or didn’t file the return. Instructions on which of the two actions to take will be clearly stated in the letter.

- Important: Don’t file Form 14039 if you received any of the letters (5071C, 4883C, or 5747C).

How to prevent identity theft of a deceased person

When someone you love passes, the last thing you want is for scammers to dishonor their memory.

But here’s the cold, hard truth: scammers target the deceased, too. Here’s what you must do to minimize the risk of identity theft for your loved one:

- Lock down accounts. Notify banks, mortgage lenders, credit card companies, and investment firms. Give them a copy of the official death certificate and ask for all accounts to be frozen or closed. Note that you must either be an executor of your loved one’s estate or have legal authority to act on their behalf.

- Alert the credit bureaus. Call Equifax, Experian, and TransUnion. Place a “deceased alert” on your loved one’s credit file. This prevents scammers from opening new lines of credit in your loved one’s name.

- Stop all automatic payments. Contact utilities, ecommerce platforms, and membership programs to cancel all subscriptions and payments.

- Close all online accounts. Close or memorialize social media and email accounts. As an example, here’s how to memorialize a profile on Facebook.

- Avoid oversharing. Don’t put sensitive info like birth dates, addresses, and maiden names in obituaries.

- Redirect snail mail. Forward all mail to a trusted family member to stop thieves from stealing sensitive documents.

- Stay vigilant. Continue monitoring credit reports for any suspicious activity.

If the unthinkable happens, here’s how to report the identity theft of a deceased person:

- If the identity theft involves financial accounts, obtain a copy of your loved one’s credit report from Equifax, Experian and TransUnion. Next, follow the steps found in the ITRC Action Plan: Resolving Financial Identity Theft.

- If the identity theft involves someone using your loved one’s identity to obtain employment, file taxes, or access government benefits, follow the steps found in the ITRC Action Plan: Resolving Government Identity Theft.

- If the identity theft involves criminal action, follow the steps found in the ITRC Action Plan: Clearing Your Name From Criminal Identity Theft.

- If the identity theft involves someone obtaining medical services in your loved one’s name, follow the steps found in the ITRC Action Plan: Correcting Medical Records Due To Identity Theft.

Tip: Be sure to let creditors, government agencies, law enforcement, and healthcare entities know you’re acting on behalf of your deceased loved one and be prepared to show proof such as a copy of the death certificate and Letters of Testamentary.

What scammers actually want (but don’t want you to know)

As mentioned, scammers aren’t just working smarter, they’re getting faster. With AI, they can forge documents and hijack accounts at speeds that were impossible a decade ago.

But here’s the question: What are scammers actually after?

Answer: It’s your passwords, login credentials, and personal data.

These are the keys to your email, ecommerce, and bank accounts. Once scammers get in, they can harvest info like your Social Security number, payment details, medical history, lifestyle habits, and income level.

With that info, they can apply for loans, credit cards, services, and government benefits. Either way, you may end up with a mountain of debt, a ruined credit score, and a damaged reputation before you even realize what’s happened.

How password management and Dark Web Monitoring locks down your digital life

With LastPass, you have an ally against identity theft.

Here’s what you get with a free trial of LastPass:

- Strong password creation so easy your six-year-old can use it: With the LastPass password generator, you can quickly create long, unbreakable passwords for every account. And you never have to remember them - our autofill function enters your login credentials securely every time you access an account.

- Military-grade encryption for your most sensitive data: Your credit card numbers, passport, driver’s license, and other private details deserve more than sticky notes or browser password storage.

With LastPass, your data is secured with AES-256 encryption (the same type used by governments and the military).

And with our Zero Knowledge framework and globally distributed infrastructure, your vault assets not only remain private to you, but you also get fast, uninterrupted access, whether you’re home or on the go.

- Secure sharing anytime, anywhere, and on any device of your choosing: Need to share a password or sensitive document? Only the people you choose get access. Our secure sharing feature ensures your info is never exposed to scammers.

- 24/7 Dark Web Monitoring so you can rest easy: LastPass Dark Web Monitoring scans the secret places of the internet, watching for any leaks of your email or login info. If your email is found compromised, you get instant alerts so you can act fast to update your passwords and keep scammers out.

But don’t take our word for it. Read what our satisfied customers have to say:

LastPass is the only password manager you will ever need, says Stacey M, IT System Administrator

What I like best about LastPass is how easy it is to use and the number of features it includes. It was super easy to implement in our company. We use LastPass daily and we appreciate the great customer support.

LastPass has solved the issue of having to remember several passwords for all of the different places you log into, and it also gives an assessment of your passwords, how frequently you use the same one, and how secure they are. The benefit of that is we have more security and less issues with passwords being hacked.

I cannot imagine my life without LastPass anymore, says Boris G, CEO and Salesforce tech lead

It is effortless to use on all devices, with very good functionality that makes it fast and seamless.

So, don’t wait for the next attack to destroy your way of life. In the war against identity theft, proactive action is your greatest defense.

Get your free access to LastPass now (no credit card required) and experience the peace of mind enjoyed by millions.